Why are we seeing rise in corporate insolvencies and is this normal or sign of a bigger problem? Coface economist, Jonathan Steenberg, gives his insights into the big picture and explains the reasons behind the rise in corporate insolvencies in Ireland.

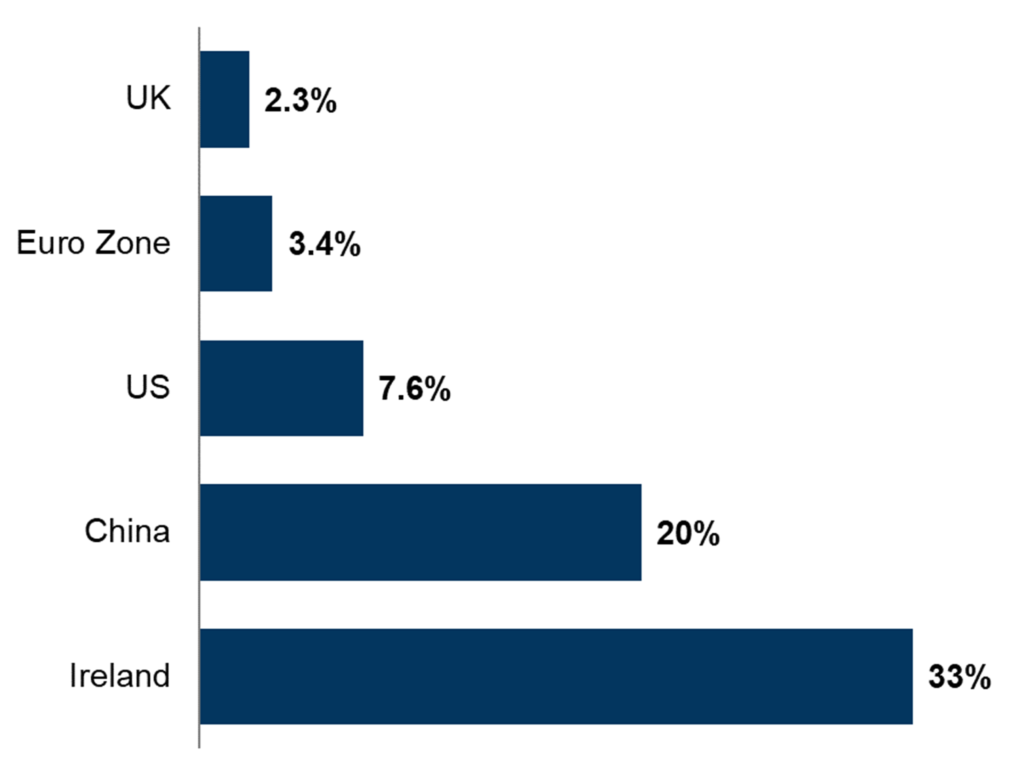

The Irish economy has in many ways been an outlier in recent years with economic activity rising by 6.2% in 2020 while the rest of Europe saw GDP fall substantially – GDP fell by 10.4% in the United Kingdom (UK) and by 6.2% in the Euro Area for comparison. In the following two years, economic activity grew by double-digit figures (+13.4% in 2021 and +12.2% in 2022), meaning the Irish economy was around 35% higher in the first half of 2023 compared to H1 2019, the last pre-pandemic year (Chart 1). This is substantially higher than the small 2.3% rise in the UK, a 3.4% rise in the Euro Area and 7.6% in the US; and even higher than the 20% that the Chinese economy has grown since the first half of 2019. The Irish economy grew quicker than China by a factor of 1.6 and a factor of almost 10 compared to the Euro Zone.

Chart 1: Difference in GDP between H1 2023 to H1 2019 – Source: Datastream, Coface

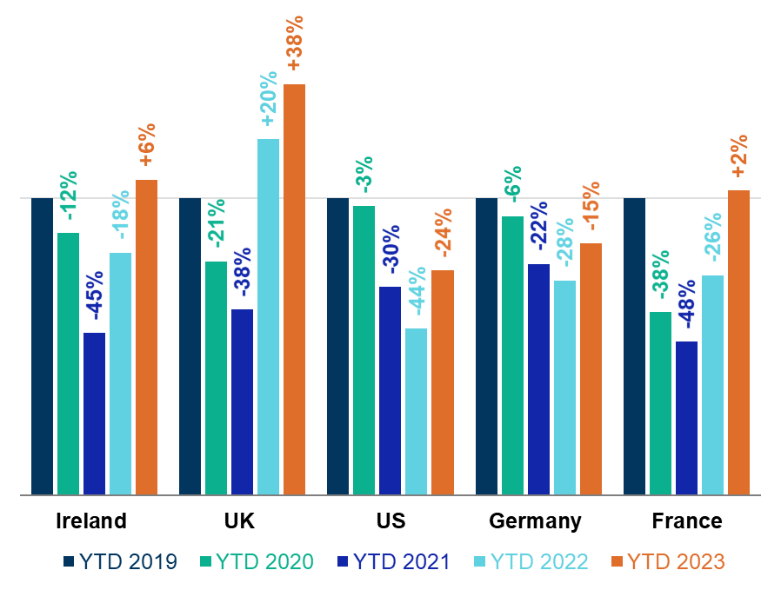

However, one way that the Irish economy has moved with majority of the Euro Zone economies was that corporate insolvencies fell in late 2020 and 2021 – due to wage subsidy schemes, COVID-19 loans and changes to requirements for winding-up petitions – and only partly increasing in 2022. This was like, for example, France that similarly saw its level of insolvencies return to pre-pandemic levels in the first half of 2023 after three years of low amounts (Chart 2). Meanwhile, the UK already saw a large rise in 2022 with insolvencies almost doubling year-on-year after support schemes ended and COVID-19 loans and deferred taxes had to be repaid, and the trend is continuing in 2023.

Chart 2: Corporate insolvencies in selected countries – Source: National sources, Datastream, Coface

Now that the first half of 2023 has passed, it is becoming clear that corporate insolvencies are slowly returning closer to normality in Ireland as the number rose by 30% year-on-year and the number of corporate insolvencies are now 6% higher than in H1 2019 – the last full year without government support measures.

In the current economic environment in which the Irish economy is stable but the global economy is slowing down, some companies are struggling with an environment defined by high interest rates, high costs and sluggish demand. In addition to this, there have been several companies kept alive in recent years thanks to the government support and/or low interest rate – so-called zombie companies – that are now having to adapt to the new reality.

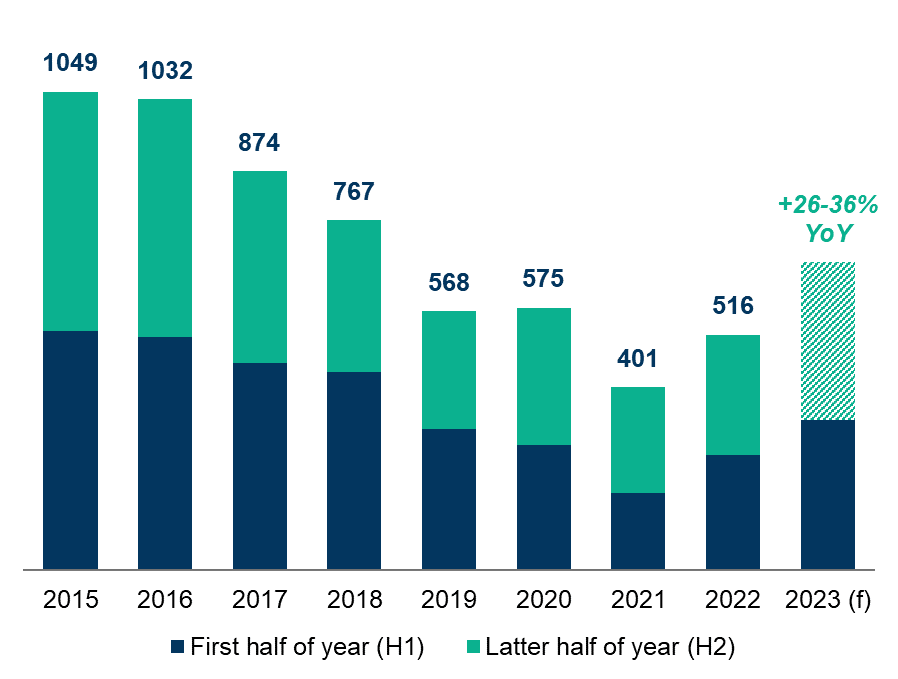

Chart 3: Corporate insolvencies and forecast – Source: Deloitte, Coface

There is also a delay in the rise of insolvencies caused by legislation. The Covid Act that increased the required debt to file a winding-up petition from EUR 20,000 to 50,000 – among other things – has been extended to end-2023, and the Revenue Debt Warehousing scheme that allowed companies to ‘park’ their tax liabilities will end by March 2024. The last year of the scheme will also see interest accrued on company debt, only 3%, but of EUR 2.2 billion outstanding. This delay is visible in the insolvency figures where court liquidations and corporate receiverships are still 30% and 45% lower, respectively, than in H1 2019.

Given these drivers, we expect that corporate insolvencies will rise between 26-36% year-on-year in 2023, which would put it above 2019 levels, but still low from a historical perspective (Chart 3).

From our perspective, corporate insolvencies in Ireland are still only normalising in 2023, not progressing to an avalanche yet. However, the end of the Covid Act and the Revenue Debt Warehousing scheme happening at the same time as a potential slowdown in the US and stagnation in the European economies could result in a more difficult situation in 2024 with further increases in corporate insolvencies.

Jonathan Steenberg,

Economist for UK and Ireland