What is Trade Credit Insurance?

Coface Trade Credit Insurance helps your business; once the payment arrears have been assessed, our experts will intervene to recover the receivable from your buyer. We implement proven collection techniques in order to maximise the chances for successful collection.

Coface pays you if your client cannot by covering receivables due within 12 months, thereby protecting your cash flow. If your customers become insolvent, you will be reimbursed for the cost of the goods and services you provided.

The benefits of Trade Credit Insurance for Small Businesses:

- Cash flow relief: one of the first and most important advantages of a trade credit insurance policy is that it protects your company from fluctuations in cash flow, specifically those caused by bad debts and insolvency, which make it extremely difficult for a company and its owners to recover in the future.

- Sales growth: Trade Credit Insurance enables your business to expand and thrive without trouble. It allows you to increase credit lines with existing customers and ensures that your business runs smoothly even if your debtors do not pay.

- Get early warning signs: A trade credit insurance policy can assist you in detecting early warning indications of future payment problems. You can investigate high-risk organisations and notify your company to avoid financial losses. As a result, Trade Credit Insurance ensures that you can conduct your business with confidence.

- Profitability: Improve your profitability by safely increasing your exposure to more customers.

How does Credit Insurance work?

When you set up a credit insurance policy, you provide information on your business and your customers, including a list of top buyers and a recent loss history. We review the financial health of your buyers to establish credit limits and trade credit terms, such as the maximum invoicing period and your premium.

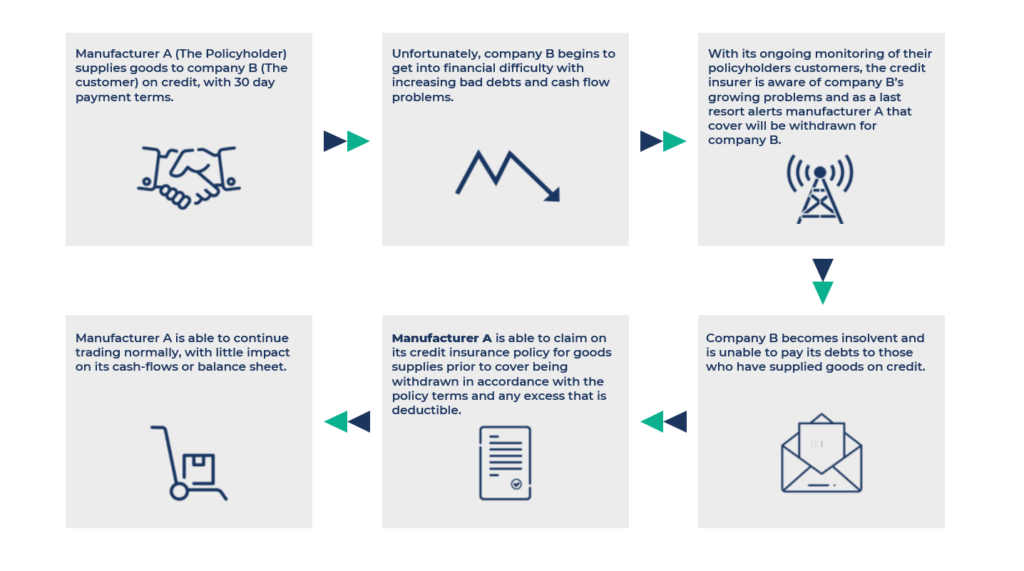

If a customer does not pay when they should, usually within 30 days or more, or within any extended time, you can notify us, and we will collect the debt on your behalf. If the company becomes insolvent or is unable to pay the balance they owe, you can file a claim to recover the debt. The following diagram explains how it works:

Four good reasons to choose Coface Credit Insurance:

- Anticipate and address customer payment arrears;

- Benefit from Coface’s Business Information intelligence;

- Obtain personalised guidance from a Coface expert in your market.

- Focus on expanding your business.

Products and cover:

The EasyLiner cover for SMEs:

EasyLiner is an SME credit insurance offer that protects against domestic and export invoices. Payment defaults can be a real threat to the sustainability of a business. Our solution offers three essential elements to ensure smooth and efficient management of the credit you grant to your customers:

- Information and advice on your buyers to prevent any non-payment,

- Collection of your unpaid invoices,

- Compensation up to 90% of the guaranteed claim.

This unique “all-inclusive” offer is available for less than 1% of your turnover on credit, depending on your needs and the options taken out.

The TradeLiner cover for SMEs:

TradeLiner Credit Insurance was designed to help small and medium-sized businesses grow. It is a comprehensive credit insurance policy that safeguards companies against unpaid invoices and customer insolvency. TradeLiner is an important tool that provides financial risk management services to your organisation, bringing financial stability and facilitating healthy growth.