What is credit insurance?

Credit insurance provides cover for businesses against non-payment of short term finance, such as invoices, from your customers. Businesses frequently come across issues related to unpaid and overdue invoices, but credit insurance helps to safeguard your company against unpaid debt. It gives you the confidence to extend credit to new customers and improves access to funding, often at more competitive rates.

Put simply, should the worst happen, such as a customer’s insolvency or protracted default, credit insurance can protect your bottom line and maintain your cashflow.

What is commercial credit insurance?

Commercial credit insurance is another term used for credit insurance. There are many different terms used to describe credit insurance including: trade credit insurance, export credit insurance, invoice insurance and bad debt protection.

How does credit insurance work?

When you set up a credit insurance policy, you provide information on your business and your customers, including a list of top buyers and a recent loss history. We review the financial health of your buyers to establish credit limits and trade credit terms, such as the maximum invoicing period, and your premium.

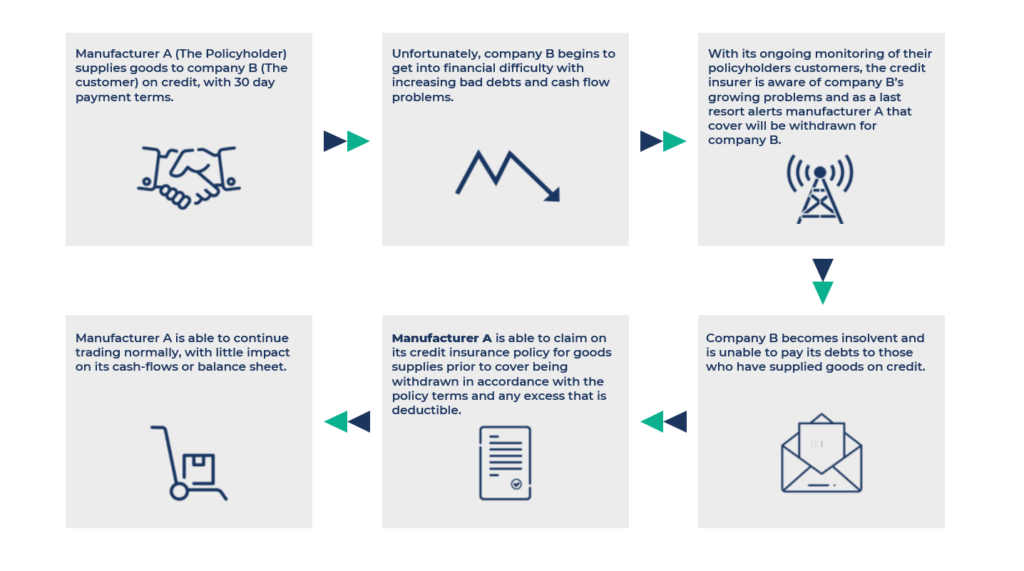

If a customer does not pay you when they should have done, usually within 30 days or more, or within any extended time, you can notify us and we will collect the debt on your behalf. If the company becomes insolvent or is unable to pay the balance they owe, you can file a claim to recover the debt. The follow diagram explains how it works:

During the course of the policy, we continually monitor your customers and adjust our credit limits, helping you to expand your business safely and avoid potential losses. Similarly, as your company expands its sales, new customers can be added to the policy. If you do not agree with our credit decisions you can apply for them to be increased, reduced, or removed. In some cases, automatic coverage up to a certain amount or percentage of sales is granted to give greater trading flexibility.

Sometimes businesses avoid trade credit insurance as they feel it will involve a lot of resource on their part, but as Rob Bowrey, Chairman Stanley Gibson, explains, Coface does most of the work for you, “It was very easy to get up and running with Coface. We gave them a list of our account customers and all the credit limits were in place before we made the transition.”

What does trade credit insurance cover?

Trade credit insurance covers you against unpaid commercial credit caused by late payments, customer bankruptcy, political risks such as sanctions introduced because of war, natural disasters, pre-shipment risks and other reasons agreed with your insurer. Credit insurance policies will vary depending on the business and the insurer.

What are the benefits of credit insurance?

Avoid risk and make sure your business recovers payments

There were 17,196 underlying company insolvencies in 2019, according to the Insolvency Service.

- According to Pay.uk, UK SME late payment debt stood at £23.4 billion in 2019, with 54% of SMEs affected by overdue payments.

- Research by the Federation of Small Businesses (FSB) showed 62% of small businesses were subject to late or frozen payments because of the Coronavirus pandemic.

- The UK Small Business Commissioner reports that 20% of UK small businesses have experienced cash flow problems due to late payments.

- It is estimated that a quarter of company failures are due to defaults on payments.

- Chasing unpaid debts incurs additional costs (collections agencies, legal proceedings etc.) and demands on your time, causing an unwelcome distraction from your real purpose.

Why use Coface Credit Insurance?

Coface is considered one of the top credit insurance companies and has been a global leader in credit insurance for 75 years. With Coface, you can:

- Safeguard your business against bad debt and establish realistic credit limits for customers

- Run credit risk checks to monitor the financial health of your customers and assess risk before you trade

- Access our debt collection service to rapidly collect late payments

- Unlock better financing options, including more favourable borrowing terms

- Identify opportunities for growth both domestically and in new markets

As John O’Connell, Group Treasurer, Origin Enterprises explains, “Coface are a valuable source of information about potential and existing customers and will go out and meet a customer if necessary. That adds significant value for us.”

What makes Coface one of the best credit insurance companies?

Is a credit insurance policy different from other types of insurance?

Yes. With most types of business insurance, such as employers’ liability or buildings insurance policies, you have little contact with the insurer between renewals, unless you make a claim.

By contrast, the best credit insurers actively support your trading throughout the year and provide an early warning system should changes in the risk status of customers occur. This help you avoid foreseeable losses.

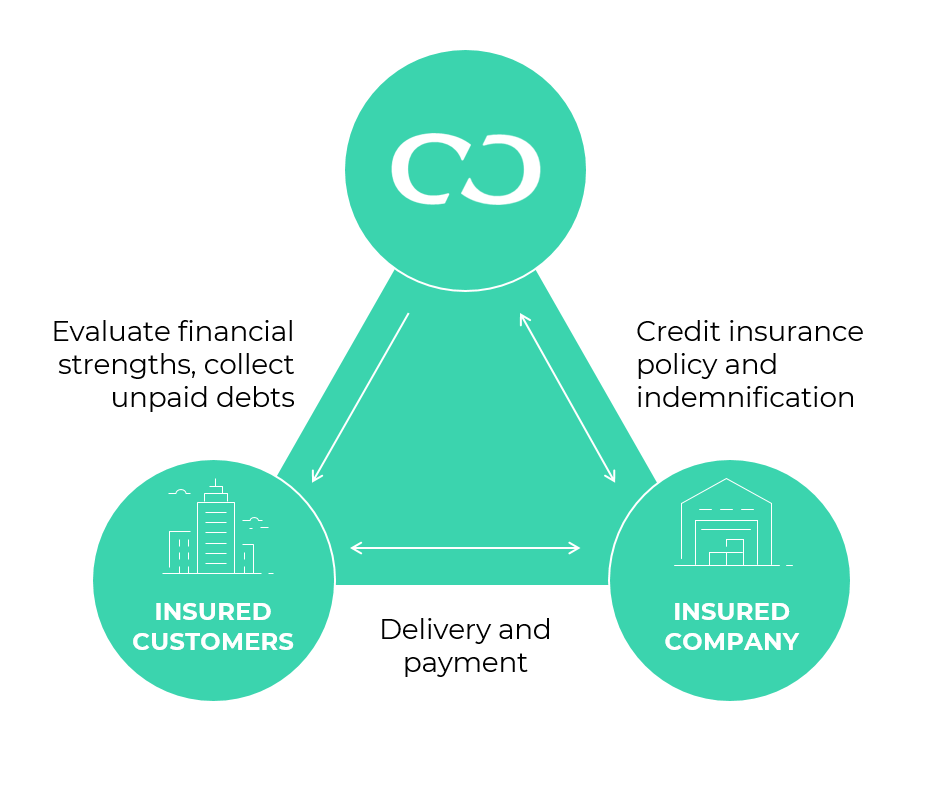

To be effective, credit insurance should be a partnership between both parties. You tell the insurer about customers’ payment behaviour and notify the insurer of overdue payments and the insurer feeds this customer information into its database, alongside data from other sources, such as financial statements and public records.

At Coface, we give you access to a wealth of business intelligence and by working with you, we can determine the level of credit risk, adjust the level of cover and agree credit limits. The diagram below shows how this works:

How much does trade credit insurance cost?

There are credit insurance policies to suit all budgets. Trade credit insurance cost is referred to as premium and is generally set according to your turnover and business profile, including industry sector, number of customers and previous loss history.

After an assessment, we will provide a quote that sets out price and policy terms, including amount of cover, level of self-retention (typically 10%), and whether there’s a deductible or minimum threshold for claims. Contact us to get a quote today.

Is credit insurance right for your company?

Whatever sector you work in, Coface credit insurance policies are taken out specifically for your situation. Coface not only offers credit insurance for the United Kingdom and Ireland, but also companies that operate internationally, this also allows your company to grow safely into new foreign markets.

Even if you have checked in advance whether your customers are reliable, the current economic climate has affected all businesses. The COVID-19 pandemic, current recession, and rapidly changing financial health of many businesses have made credit insurance more important than ever. In uncertain times, you need to be certain your cash will keep flowing. Credit insurance offers the solution for this.

With a Coface credit insurance you will receive extensive information about your customers, we will carry out the collection for you and pay claims when your customers can’t. This is why many of our customers would recommend using Coface credit insurance including Irene Rous, Credit Control Supervisor, Smeg UK; “we would recommend Coface because the policy is so flexible and easy to manage. When we had to make a claim, the service was very good and they paid within a month.”

How else can credit insurance benefit businesses?

Better banking terms

Banks are more likely to lend to businesses that have credit insurance, and some banks make it a requirement as Sergio Vignone, Credit Manager, explains, “As traders, we obtain working capital from our bank and then we receive our money when the customer pays. The banks themselves make credit insurance a condition for access to trade finance.”

However the benefits are that borrowing costs are also often lower and the opportunities and cost savings provided by trade credit insurance can offset the cost of the policy.

Improved cash flow

Your cashflow is powerful yet vulnerable resource and you know the importance of protecting yourself against unpaid invoices and insolvencies. Credit insurance helps companies avoid risks and replaces cashflow should the worst happen and a customer insolvency or non-payment occur.

Mitigate against loss

For example, a manufacturer with a margin of 4% that experiences a non-payment of £50,000 would need 25 equivalent sales to make up for a single instance of non-payment. Credit insurance mitigates against this loss.

Save money on expenses

You can cut spending on credit information as that’s covered, and you won’t need to waste resources on chasing collections. Your company can also deduct the cost of the policy as a business expense.

Free up bad debt reserves

Capital set aside as reserves can be freed and converted to earnings.

Increase sales

Credit insurance lets you offer more competitive credit lines to existing customers as well as identify new market opportunities. Making it easier to grow your business. Multiplying this increase by several customers could easily offset the cost of a policy

Business development

By entrusting the protection of your debtor book to credit insurance you can focus your time on business development. Additionally Coface offer a global analysis of country, sector and company credit risk in real time giving you the freedom to pursue your growth strategies with confidence.

Supplier relationships

You may be able to negotiate favourable terms with your suppliers as a credit insurance policy reduces the impact of a bad debt on them and potentially the whole supply chain.

Peace of mind

Credit insurance is there to help you prevent and mitigate your trading risks, so you can develop your business with the knowledge that your accounts are protected. Credit Insurance is there to help you take the right decisions.

Real life example of using credit insurance to increase profits

A business wanted to expand sales with its current customers but was not completely comfortable offering them higher credit limits. They contacted Coface credit insurance to cover the higher credit limits so they could increase the amount of credit offered to customers without risk. This let them grow revenues and deliver more profits. This business was able to capture £300,000 of incremental gross profit from just one trading partner. These benefits can be multiplied across a broad portfolio of its customers.

Real-life example of using credit insurance to improve lending terms

A wholesaler of chemicals and raw materials improved its ability to secure credit by adding credit insurance. The company, which sells to overseas customers, needed to provide more transparency to its lender, who was concerned about foreign receivables in the borrowing base. “We purchased trade credit insurance initially to facilitate the perfection of our credit line facility,” says the Managing Director and CFO. “From the initial objective of providing comfort to our banks, the service added depth to our business decisions.”

The interaction allowed the company to assess its clients’ condition more accurately and has been a valuable tool in business development.